It’s shorthand for the chief problem of transitioning a local news operation’s business model from print to online: Newspaper revenue dollars become online pennies. Despite increasing readership online, advertisers continue to pay a much higher price when they place their ads in print.

It’s shorthand for the chief problem of transitioning a local news operation’s business model from print to online: Newspaper revenue dollars become online pennies. Despite increasing readership online, advertisers continue to pay a much higher price when they place their ads in print.

A lot of that has been laid to inertia on the part of advertisers and a lack of sales imagination at papers. But there’s also something very real at play as well: the loss of scarcity.

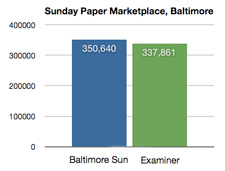

This can be see in some very simple numbers. At the right are the two places a print advertiser can distribute a message, for instance, in Baltimore, MD on a typical Sunday. They can choose The Sun or The Examiner. Or, if they’re feeling especially flush, they can choose both. Even with greatly diminished circulation, the local newspaper remains the best way to put your ad in the hands of a lot of local people. And in most major markets, there’s only one — or at best two — organizations that can pull that off. Scarcity.

But what happens the same advertiser wants to reach online users in a metro market? That’s when the picture gets a lot more complicated for traditional local publishers.

The chart below is comScore’s November 2008 breakdown of the top 30 online destinations in that same market, Baltimore, by percentage of market share. The pink bar represents Tribune Interactive, parent of The Baltimore Sun (click chart for a larger image):

Online is a world of nearly infinite choices for advertisers. And this chart represents only the very beginning of a very, very long tail. The local newspaper group is at position #25, sandwiched between the Weather Channel and Superpages, and just a few clicks ahead of craigslist. The head of the pack are Google, Microsoft, Yahoo, AOL and Fox. Huge national players dominating the local market.

Without scarcity to sell (“You have to go through us to reach the local market”) newspapers are stuck. Not only do they need to continue to bear the burden of local newsgathering, but they can’t underwrite those costs anymore as print dollars dry up and online prices are driven down by the sheer amount of online ad inventory.

You may have the best salespeople in the market. But given the abundance of options for an advertiser, the price of online advertising — as measured by CPM (cost per thousand) — is sure to head down.

Given this downward pressure and the reality that local newspapers are unlikely to move significantly further to the left in the chart above, a new revenue model is called for, one that turns away from the old model of “selling eyeballs” in bulk and moving toward one that leverages their unique local focus, creating revenue streams valued by their localness and their uniqueness.

It’s time to take a few lessons from Apple Computer.

Tomorrow: Why the notion of an “iPod or iTunes strategy” is actually a move in the right direction. But maybe not the direction you’re thinking.