You may have come across the chart-making work of blogger Michael DeGusta last month, when he recrunched some numbers on the music business that illustrated that industry’s financial decline. And now he’s cast his axis-loving eyes upon the newspaper business and, in particular, the Newspaper Association of America’s release last week of 2010 advertising revenue numbers.

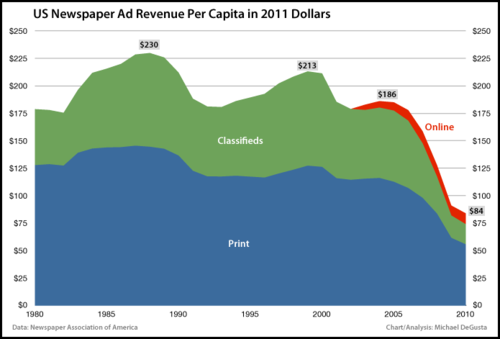

The result is what you see above, which (a) gathers together NAA ad revenue totals since 1980, (b) adjusts for inflation, putting it all in 2011 dollars, and (c) adjusts for population growth, making the dollar figures per capita. So each point in the chart indicates how much ad money the newspaper industry made from the average resident of the United States per year.

(And, to repeat, everything in this chart and this post covers only advertising revenue, not overall revenue — so circulation money isn’t included. Although that hasn’t exactly been a great multidecade success story, either.)

If you’re an optimist about the industry’s financial future, then you can take comfort in that little turn toward horizontal at chart’s end — the sort you see at the bottom of a park slide and associate with childhood and grassy lawns and safe landings. If you’re me, you think about how you’re sitting on the ground, your pants are all dirty, and it’s gonna be really hard to get back up the slide now that someone’s taken away the stairs. Two quick observations from the chart:

— While it’s easy to blame the Internet for newspapers’ ills, note that overall ad revenue per capita had been stagnant (with exceptions for the broader business cycle) for decades. Newspapers were making roughly the same revenue per capita in 1980 as they were in 1993 or 2001 — all before the precipitous decline of the past few years.

That revenue stagnation happened in a context of real GDP-per-capita growth (see slide 6), which is why the newspaper business’ share of overall advertising revenue in the United States has been declining since at least the 1940s (see slide 5).

— That red online slice doesn’t look to be growing at a rate that’ll comfort the entire industry, does it? Compare DeGusta’s analogous chart for the music industry, where at least the digital-revenue slice seems to be at least adding something substantial to the mix, even as music’s non-digital numbers are tumbling even faster than newspapers’.

NAA’s numbers showed a 10.9 percent increase in online ad revenue from 2009 to 2010. But that means that 2010 online ad revenue was still below 2007 levels.

Or: After a decade of worrying about the Internet, after the collapse of its print advertising base, still only 12 percent of newspaper ad revenue came from online. (And, of course, a much tinier slice of circulation revenue.)

Or, perhaps most galling of all: Even after a decade-plus of eBay and Craigslist and Match.com and the rest, online revenue is barely half as big as classified ad revenue, the one line item most folks gave up for dead years ago.

Compare those depressing numbers with those of another industry undergoing digital disruption: the book industry. New numbers from the Association of American Publishers reported that ebook net sales jumped by 115 percent in January, year over year from 2010. At $69.9 million, January ebook net sales were greater than adult hardcovers ($49.1 million) and approaching adult paperbacks ($83.6 million). Newspapers just don’t have any new digital revenue streams producing in the ballpark of that rate of growth — in part because their monopoly power has been disrupted more than that of their peer industries.