What are we to think when the aggregators start getting aggregated?

That’s what’s happening in the mobile aggregation space. Put those two little words — mobile and aggregation — together, and you’ve got intrigue. Aggregation as in the long-debated snippetizing, curating, synthesizing, and more of the voluminous news content created by legacy companies — the kind of aggregation that once drove U.S. publishers mad and still drives German ones into a tizzy. Mobile as in the newest new, the landscape to which we’re all going — the untethered, Steve Jobs-powered Internet without cords.

So mobile aggregation is the hottest thing around. Ask Akshay Kothari and Ankit Gupta, the cofounders of tablet aggregator Pulse. Their three-year-old company just exchanged its independence for $90 million in fast-climbing LinkedIn stock. Ask 17-year-old Nick D’Aloisio, the English teenager who was the face of smartphone aggregator Summly and traded it to Yahoo in March for about $30 million. Ask Mark Johnson, CEO of Zite, which CNN snapped up last summer for a little less than what D’Aloisio got. All of that leaves the mobile aggregation leader, Flipboard, alone in its independence. It also makes it a greater object of affection. As Google and others eye Flipboard, its price tag has now reached $400-500 million.

So what we can make of this spate of deals, and what do they mean to news companies? As the unhealed wounds of the first round of web aggregation still chafe, what did publishers learn from it and how are they approaching this next mobile round? What are the newsonomics of this great mobile roundup?

It’s absolutely clear why companies are (over-)spending on mobile aggregator plays. Mobile is the greenest field around. We — news consumers — are flocking there. The speed of our migration is breathtaking. About a third of all traffic to news sites now comes from mobile, up from just 25 percent a year ago. Tablet usage, as early adopters are joined by legions of others, keeps growing, and smartphones (which just officially passed dumb phones) are markedly increasing news audience consumption worldwide. (The New York Times debuted a new mobile site yesterday, with the promise of more mobile movement to come.)

The common belief: Mobile traffic will exceed web traffic within two to three years.

But mobile monetization still gives everyone fits. Match up the 33 percent usage number for news publishers against ad monetization that amounts to no more than 10 percent of their overall digital advertising; for most, it’s considerably less than that.

Google and Facebook are, of course heavily investing in mobile ad plays; with Facebook’s last financial report viewed favorably because of its mobile progress. Neither are there yet; even as the tablet holds immense ad potential, the small screen of smartphones bedevils marketing muscularity. If you compare time spent on various platforms to ad money spent, mobile time is the most underrepresented. That will change, and the smartest digital ad players know today’s game is all about positioning, being ready to benefit from the flow of ad dollars, euros, and pounds as money moves more quickly from print, and yes, even web to mobile.

Mobile’s great ad growth is captured in the mid-April IAB (Interactive Advertising Bureau) report:

For the second year in a row, mobile achieved triple-digit growth year-over-year. The past year saw the mobile category surge 111 percent to $3.4 billion, pivoting off of 2011’s record-breaking 149 percent year-over-year rise to $1.6 billion. Mobile accounted for 9 percent of total internet ad revenue in 2012.

So in pursuit of Google and Facebook, Yahoo is clearly playing catchup — there as elsewhere — and Marissa Mayer’s acquisition of pubescent Summly, is just one small step in that pursuit. LinkedIn’s mobile strategy has been seen as lagging; Pulse’s tablet presentation — the conveyor belt, or the Automat of the last century brought to the new — helps it further position itself as a news stop for its business influential audience.

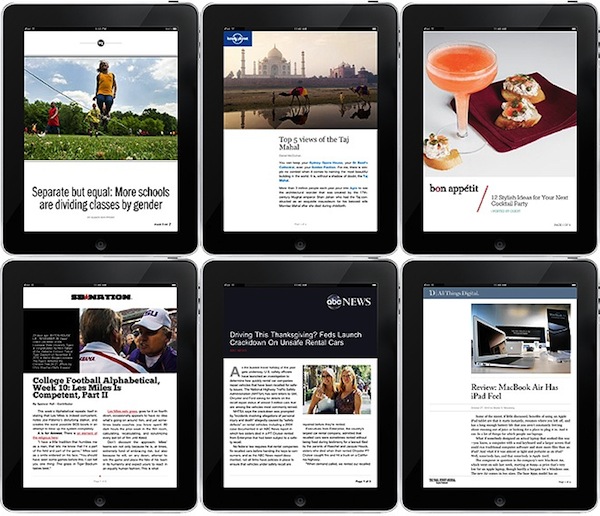

Design is an important part of these acquisitive moves. One reason these companies have value on the market is that they stand out. It must be said: For the most part, news companies have once again missed a chance to innovate, to make something new of a new platform. Flipboard, Pulse, and Zite each saw the potential of tablet news and magazine feature reading early and set to work to present it harnessing the glowing touchscreen. Now Flipboard 2.0 (build your own magazine) and Zite 2.0 are moving to a next generation. The best newspaper sites have mastered the utilitarian basics, but they hardly break new presentation ground. They also emphasize a single brand, where plainly many readers relish cross-title variety and a bit of serendipity. Innovation on tablet news design has been minimal, and it’s outsiders who largely deserve the credit for it.

One noteworthy exception: AP Mobile. While it lacks the finesse of Flipboard, it delivers a national and local experience, bringing in hundreds of local news feeds into its tablet and smartphone products, and is one of the top news apps downloaded in Apple’s App Store. AP Mobile is a rare case of newspaper cooperation, building a single customer experience; now it’s up to AP to deliver the next-generation mobile experiences.

By contrast, the magazine industry has gone another direction. Its Next Issue Media consortium stands as a first-of-its-kind compact among the Big Five magazine publishers and offers a great deal ($14.99 a month for unlimited access to 80 top titles) for consumers who want access to multiple titles. But it’s still a 1950s read-title-by-title paradigm in a partial Flipboard world (“The newsonomics of the Next Issue magazine future”).

Yes, a partial Flipboard world. Let’s return to the place of aggregation in a more mobile world. Web aggregation snuck up on news sites worldwide. At one point, Google was just a funny word. But within a few quick years, news companies saw that Google had become the web’s primary destination and that they were dependent on it for 20 to 40 percent of their traffic. They railed about the company’s unfair use of fair use, a legal doctrine born in the pre-digital age, but have been unable to do much about ceding their central place in the digital world to the search giant.

As the world’s moved mobile more quickly than anyone — including Google — expected, everyone’s trying to figure how news will be found on the smartphone and the tablet. If you’ll recall, in announcing his mobile breakthroughs, Steve Jobs declared the obsolescence of search: In an app world, who needed it? It sounded like great hyperbole, but it’s become unevenly true.

Think about how you access CNN or the Times or Slate or Fox News on your phone or tablet. There’s a good chance it’s through a tap on an app, either a native app, or one you’ve created out of the mobile browser. That’s quite different from the use of a browser’s address bar or search box we’re accustomed to on desktop and laptop. While Google still provides 20 to 40 percent of web referrals to news companies, its referral potency on mobile devices is reduced. By how much? The data is too disparate to measure precisely at this point, but the change in behavior is clear. (Just yesterday, BuzzFeed reported a significant drop in search traffic across its tracking network — although others dispute their math.)

So where do news companies find themselves, as desktop/laptop reading flattens in minutes and mobile increases? Are they concerned that Flipboard, Pulse, Zite, Summly and the rest will do what Google did to them on the web — get between them and their direct relationships with reader customers, reader customers who are now increasingly being asked to pay for digital and all-access? Not really. There are a couple of reasons why:

Given the roaring adoption of paywalls, the intersection of mobile aggregator and publisher interests reach a new crossroad. So far, Flipboard has agreed to only two full integrations, with The New York Times (allowing its paying customers full access within the app) and with the FT, which is still in progress. Flipboard tells me it is reluctant to commit to many more such integrations, especially with regional news publications. That’s understandable; it’s a lot of work, and without the scale of NYT/FT global news interest, Flipboard’s own return is smaller.

For its part, Pulse has tested a paid content niche test with the Wall Street Journal; both it and Zite have done ad sharing deals as well, but not on Flipboard’s scale.

Yet in a world in which all-access circulation is the leading core strategy, we’ve got to wonder if a distributed content strategy — such as partnering with Flipboard — is sufficiently served by simply selling advertising — even high-priced tablet ads. It may be. But much sooner than later, publishers will have to tote up their scores and see if they mastered the second round of aggregation much better than they did the first.