I’m pretty sure I purchased Civil tokens yesterday — literally buying into an experiment to strengthen journalism by putting some of it on the blockchain.

After passing two tests, uploading my passport and driver’s license to unfamiliar websites, and plunking down a large (for me) sum for a cryptocurrency, I was cleared for token takeoff. When the sale began at 10 a.m., I indicated how many Civil tokens I wanted and sent off that valuable cryptocurrency to pay for them.

And I got nothing.

No tokens appeared in my digital wallet. No comforting “your tokens are being shipped” email. Not even a “Share your purchase with a friend!” button. The “purchased” area in my account was blank.

But I’m actually at peace with that. I think it’s going to work out, and I’m into this journey.

Earlier this year, my friends Manoush Zomorodi and Jen Poyant left their public radio jobs to join this new journalism…thing named Civil. I had heard tidbits about Civil, and was honestly pretty confused. All the smart people I talked to seemed confused, too.

Manoush’s and Jen’s podcast ZigZag attempts to explain it, and I think I can take a stab now: Civil is a system designed to foster and reward quality journalism in a decentralized way, in contrast to platforms like Facebook and Google. The system’s backbone is the blockchain-based Civil token, abbreviated CVL. Holders of tokens can start news organizations in the system, challenge the membership of other news organizations in the system, and/or cast votes when such challenges arise.

I have no idea if it will work. But I’m interested, and I’d rather participate than watch from the sidelines. So I was willing to give it a whirl — and was okay with losing a little money in the process. (Plus my employer, Quartz, just launched a new cryptocurrency newsletter called Private Key I’ve been reading.)

So the time seemed right to jump in. I just needed to buy some CVL…though it turns out there’s no just about it.

Here’s what I actually needed to participate:

Quick note: I’m talking about real money here and there was a moment when I technically lost $100. So please don’t take my experience as gospel, or even 100 percent accurate — I’m a beginner at this, I expected to be imperfect along the way, and even Civil’s instructions have changed in the last few days.

That said, about a week ago, I followed the path described in this PDF. Here were my steps.

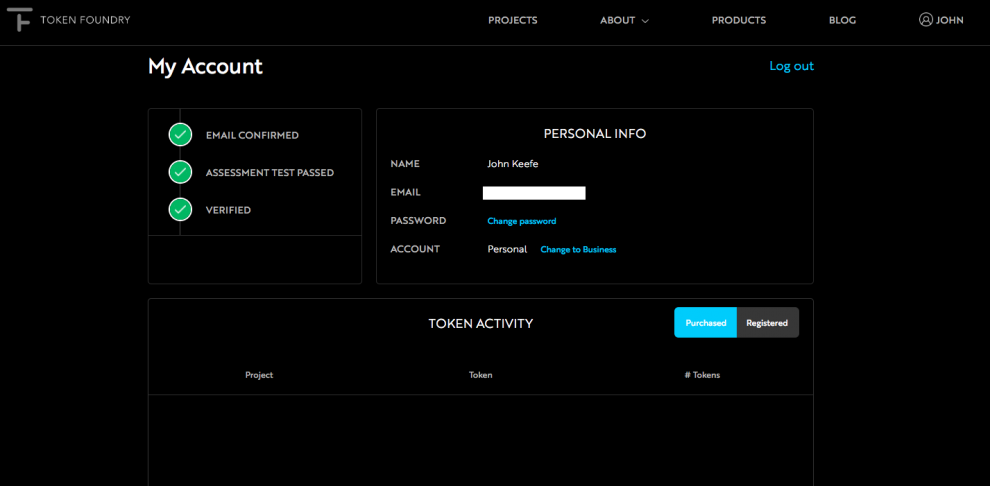

First stop was at Token Foundry, the site from which I’d eventually purchased my CVL tokens. At this point, I:

To get CVL, I needed to register for the sale at Token Foundry. So I:

The upshot is that CVL isn’t designed as a way to get rich quickly. Fortunately, that wasn’t my goal. Also, I’m bad at that, always.

I would soon need to turn real dollars into blockchain-based cryptocurrency — in this case, Ethereum tokens, which is abbreviated ETH. I needed ETH to buy CVL.

Two things have changed since I did this. First, Civil announced that, starting October 2, they would allow people to buy CVL directly with dollars — so no need to buy ETH first. Second, the website recommended to buy ETH shifted from Coinbase to Gemini.

I used Coinbase, and on that site, I:

At this point, I was ready to inject real dollars into the process.

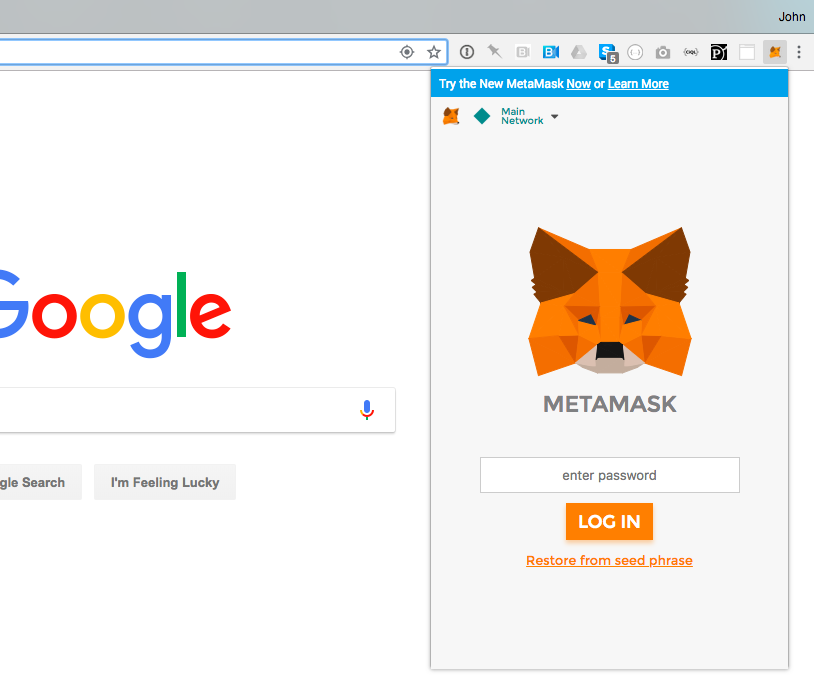

But neither Coinbase nor Token Foundry is where I’d actually buy, sell, or exchange tokens. That happens in Metamask.

Metamask is a browser extension that added a little fox icon to my browser’s toolbar.

Clicking the fox opens a window where I could buy Ethereum and, later, exchange Ethereum for CVL tokens. It is also the temporary “hot wallet” where I can store my Ethereum and CVL tokens. (For longterm storage, I’ll use a “cold” hardware wallet.)

So here’s how I set up and used Metamask:

And it didn’t work.

Turns out I was trying to buy too much. I knew the Coinbase limit for debit cards was $300, so I entered $300. But it failed.

I tried $299. Also failed.

I figured out that there were some transaction fees that were putting me over the limit. So I tried $250.

At this point, my bank was on high alert and declined the transaction. (I later confirmed this when I had to ask my bank to unblock my card.)

So I gave Coinbase another debit card, which promptly got declined. I was clearly setting off alarms everywhere. (Again, confirmed.)

Finally, I tried linking a bank account directly to Coinbase. The instructions said this could take up to seven days to go through, which was okay because I was still more than a week out from the CVL token sale. But since my bank was on the Coinbase list of banks it can readily talk to, it worked right away.

I went back to the Metamask window and yet again tried to purchase Ethereum, this time using my bank account.

And it…worked?

The sale went through, it said. But there was no deduction in my bank account and no Ethereum in my Metamask wallet. Was it gone?

Then I found that there was Ethereum in my Coinbase account. Maybe this was the seven-day wait?

The next morning, the Ethereum was sitting in my Metamask wallet.

And…it had already dropped in value by $25. It would drop a full $100 — and then recover — before I got to use it to buy CVL. As the excellent Quartz headline writers point out, the cryptocurrency markets had suffered a “sudden and severe faceplant.”

But I was ready for the sale.

At 9:59 a.m. Tuesday, I popped open my laptop. The Civil token sale opened a minute later.

I went to the Civil site on Token Foundry and clicked “buy.”

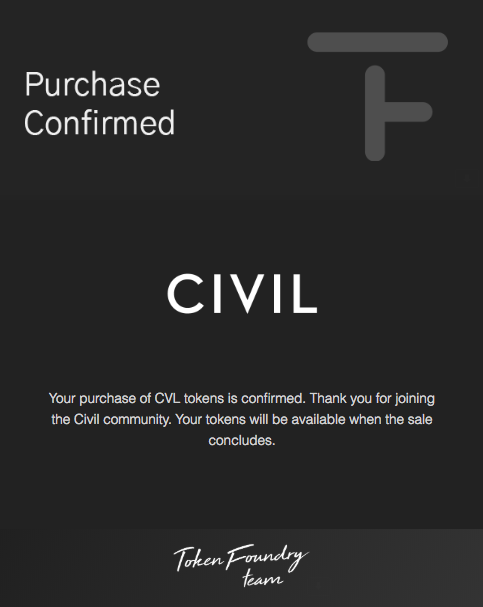

For my payment method, I chose “Metamask,” the browser plugin and cryptocurrency wallet holding my Ethereum. I confirmed the purchase amount, waited a minute and saw this:

Nice!

I even got a link taking me to the digital details of the transaction on the blockchain, clearly showing my ETH went to Token Foundry.

But there was no record that once there, those tokens had become CVL tokens, or even that they will at some point in the future. The only receipt I had of a CVL token transaction was the “success” screenshot above I happened to snap because I planned to write about my experience.

After reading so much about the immutability of blockchain records and keeping your cryptocurrency secure, the lack of even a “pending” transaction record was a little odd.

But I wasn’t concerned. One thing I’ve learned in this process is that the Civil folks have thought a lot about this system and this sale. Plus, I had both the screenshot and a blockchain transaction showing I sent Token Foundry a bunch of Ethereum.

Then, about 6 p.m. Tuesday evening, eight hours after clicking “buy,” I got a comforting “your purchase is its way” note from Token Foundry:

Of greater concern might be that the entire sale won’t go through at all if Civil doesn’t sell more than $8 million in tokens by October 15.

After exactly 12 hours, the tally of CVL sold was at $98,984. At that rate, assuming people buy 24 hours a day, I think Civil would come up a couple million short. [Editor’s note: After 24 hours, at 10 a.m. ET Wednesday, the total was at $116,655.]

I hope I’m wrong. I’d like to see how this experiment plays out — and I have a small stake in it.

John Keefe is a product manager and bot developer at Quartz.