What can the U.S. learn from European news innovation?

Yesterday, we focused on Finland’s Sanoma and its worldwide leadership in digital circulation revenue. Today we look at Schibsted, now the eighth largest news company in the world by revenues, just behind The New York Times Co. It now operates in 28 countries; 36 percent of its revenues come from digital offerings, a percentage more than three times that of the average newspaper company. Schibsted has set a new standard, in both news transformation and in the revival and updating of the classifieds business — and now it’s blazing a trail in online services, an area at which every publisher should be taking a long look.

Schibsted’s success comes from above-average execution, meeting market realities, and making early decisions to depart from print legacies and handcuffs. It is also a story of flexibility, tweaking both product and organization as the landscape and competition changes. It continues to transform, having recently reorganized its Norway and Sweden operations yet again in 2011, ringing out more efficiencies.

Back in 1999, Schibsted split its digital divisions from its newspapers, believing that the web was its own animal. The company decided that “the Internet was made for classifieds and classifieds were made for Internet,” says Sverre Munck, executive vice president for strategy and international editorial. Munck joined the company in 1994 and has served as CFO as well.

Back in 1999, Schibsted split its digital divisions from its newspapers, believing that the web was its own animal. The company decided that “the Internet was made for classifieds and classifieds were made for Internet,” says Sverre Munck, executive vice president for strategy and international editorial. Munck joined the company in 1994 and has served as CFO as well.

Other companies — CareerBuilder and Classified Ventures in the U.S. and Fish4 in the U.K. — sensed similar opportunities. Schibsted, though, unshackled top business managers to go after the business, without joint responsibility for the print classified business. Now its online classifieds are a European cousin to the U.S.’s Craigslist, the quasi-commercial venture that drained billions of dollars from U.S. dailies, having disrupted incumbents with a free-plus model. Even in distant Italy, Schibsted controls over 60 percent of digital classifieds.

It’s online classifieds revenue that has enabled Schibsted, once an old-fashioned Norwegian newspaper publisher, to generate 36 percent of the company’s total revenues from digital sources. That’s more than three times the average of the newspaper industry worldwide. While Schibsted’s core newspaper business is only a tad above-average — now deriving 11 percent of newspaper revenues from digital — it’s that major online classified push that is paving the way to a sustainable future. Online classifieds are rolled out in 28 countries, reaching much of Europe and spreading to Asia as well.

CEO Rolv Erik Ryssdal participated in a panel I moderated last fall at WAN-IFRA’s World Newspaper Congress in Vienna. Building on the foundation of his company’s pro-digital position, he believes that newspapers are well positioned to compete with broadcasters. As TV experiences stresses similar to print, as television, digital-ready news publishers will be rewarded.

“The TV stations will be under more pressure, and everything is accessible on the web, so we will continue to invest in our own digital businesses,” he said. Ryssdal is a 20-year Schibsted veteran who became CEO in 2009. He succeeded Kjell Aamodt, who stepped down after 20 years leading and building the company.

In its online classifieds business, Schibsted’s push shows what a relentless focus on product and time-to-market can produce. “We don’t do it half-heartedly,” says Munck. “We do it to win. If we don’t succeed, we sell it to someone else.” Failing faster — a Silicon Valley mantra — is also more true of Schibsted than many of its peers. “We try a lot of things and some work better than others,” he adds.

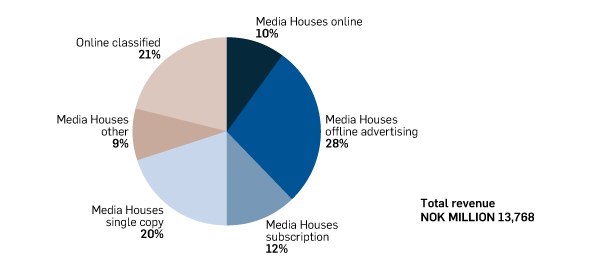

Quite instructive to the rest of the newspaper world is the breakdown of Schibsted’s overall revenue, from its 2010 annual report:

It draws 21 percent of all revenue from online classifieds. Its reliance on print advertising — or as the company refers to it, “offline” advertising — is far less than most publishers, at 28 percent. It faces perhaps more challenge in the digital transition in retaining circulation revenue, which now accounts for 32 percent of overall revenue — 20 percent from single copy and 12 percent from subscription. As most news companies reliant on single-copy sales will tell you, figuring out a strong digital pay program for those customers is far more difficult than for subscribers. For Schibsted, some flavor of an all-access model could work.

The transformative accomplishment here: reliance on print advertising and circulation money to support Schibsted’s journalism has been significantly reduced. While Schibsted won’t claim to have found a model that will sustain current-sized newsrooms indefinitely into the future, it’s farther along in building that model than anyone other news-focused company.

It’s useful to look at Schibsted through three lenses — its two current business units and one emerging one — to divine the models that others may apply.

In online classifieds, one of the lessons Schibsted learned is that being less than the market leader isn’t worth much on the web. Dominance takes time to build, but it pays off. It leaves little room for others to compete. Remarkably, given its premium position in so many marketplaces, online classified revenue is growing at a 20 percent annual clip.

It made its decision to separate online classifieds from print after seeing the fast deterioration in its home market, Oslo. Its daily Aftenposten saw its share of the auto classified business drop from almost 100 percent of the market to 20 percent in just three years. Today, digital auto classified revenues are higher than print, and, given the Internet’s unique database capabilities, there’s little print auto business left.

Schibsted operates online classifieds businesses in 28 nations; in 20, that’s its main business. Those nations can be found on three continents and now include such populous growing markets as India, the Philippines, Indonesia, and Malaysia, as well as much of Latin America. Schibsted is partnered with Singapore Press Holdings on its classifieds products (ST701.com) in neighboring Indonesia and Malaysia. It is truly a global classifieds play.

Online classifieds are based on its simple-to-use Blocket platform, first tested by Schibsted in Scandinavia. In country after country, Schibsted has introduced the product, built it to a dominating position, and began pricing actions that have made it a revenue growth engine. Last fall, it bought the 50 percent of the French classifieds site Leboncoin that a partner had owned, giving it whole ownership of that leading site.

Blocket is the third most popular classifieds site in Europe, after eBay Germany and eBay UK. For consumers, it is a broad and deep marketplace. Blocket COO Richard Bergman points to the site’s success as based on continuous, lightning-fast iteration and innovation.

In places where Schibsted has news properties, they serve as a major driver of traffic to the classified sites. The company is using the social web to drive audience, as with the recent “Funniest Classified Ad on Blocket” contest. Through Facebook, the contest drove 34,000 additional downloads of the Blocket app in Sweden.

Media houses. It’s a term we see a lot of in Europe, one borrowed perhaps from another age, but one directly useful to what newspaper companies are becoming. These are the old newspaper enterprises now configured for the multi-platform, multi-device age. As noted above, nearly two-thirds of Schisted’s revenues derive from these media houses’ print ad and circulation revenues, with one third coming from other sources.

The daily print operations start with older Scandinavian properties in Norway and Sweden and extend from there to Estonia, Lithuania, France and Spain. In Latvia, Schibsted operates an online-only news site. In both Spain and France, it operates its 20 Minutes free daily newspaper franchise. Schibsted is in the midst of figuring out how it wants to pursue some of the digital circulation revenue it sees its peers starting to take in; that’s a major priority for 2012.

While it has transitioned its overall business more than other news publishers, it shares a common problem: The new reach it has gained from digital distribution hasn’t paid off big-time in new news-related revenue.

Munck’s math is indicative:

In Norway, as in the rest of the world, impression-based advertising revenue hasn’t followed the extended reach. Despite that good reach math, Schibsted struggles to convert the readership to great advertising benefit.

That issue is well-illustrated by VG, both the leading single-copy paper in Norway and leading news site. The national single-copy paper is fast losing print circulation, with print advertising is sliding as well. Digital ad revenues, while growing, don’t make up the difference. Fully 25 percent of VG’s traffic already comes from mobile. Yet mobile produces relatively few ad revenues. Further, video is still a relatively small part of the business, with more build-out planned.

Remarkably, Munck says 90 percent of the pageviews to Schibsted’s Norwegian media sites are driven by direct traffic. That’s an astounding number, when compared to the 25-40 percent reported by many major news companies, which depend greatly on Google and now social referrals for the rest.

What’s behind that number? Schibsted long ago set up its media properties to be the first click for Norwegian consumers: “People take for granted that VG will be first with the news,” Munck says. It was more than a decade ago, or about three years after Google’s birth — when other news publishers were still debating what to hold for the next day’s paper — that Schibsted decide to go digital first with the news. That decision is reflected in that 90 percent number. The big notion: get ahead of the competition if you want to stay there.

It is now in the midst of a “one newsroom” project, taking its multimedia news generation to the next logical level.

Like many publishers, Schibsted has also experimented with free print dailies, in its case 20 Minutes. It’s a quick-read newspaper started in 1999, now operating in Spain (15 cities) and France (32 cities). Schibsted has sold both its Swiss and German properties, the latter after a legal battle with that country’s publishers. At €80 million, it contributes 4 percent of Schibsted’s €1.8 billion in revenue. Fifteen percent of 20 Minutes’ revenues come from digital. European’s deep macroeconomic malaise is dragging down the 20 Minutes investment; for instance, the company’s Spanish operations produced less revenue this year than in 2004. 20 Minutes appears to be a beachhead product for Schibsted, a way for it to learn about new markets. It returns about 4-10 percent in operating margin at this point, says Munck.

Print’s deep and continuing slide led CEO Ryssdal to say in May that the company would no longer consider buying print properties outside of Scandinavia.

Though smaller in revenue, this is the new kid on the block — not yet a separate business unit, but one that will become one “soon.” Online services is charged with finding new revenue beyond the media house and online classifieds businesses — though it keeps those linkages in mind.

Revenue is about €110 million euro annually — but with a 20-percent growth rate. The big grower is www.hitta.se, a Swedish search engine that also offers mapping and Yellow Pages information. It alone accounts for about 50 percent of online services.

Overall, Schibsted is stepping up from being a provider of current news, information, and advertising into a role as a life-cycle and life-stage supplier of useful commerce-aiding content. These businesses require an increasing segmentation of the marketplace — some rooted around traditional customers, and some not.

Real estate, for instance, doesn’t stop at the traditional listings business, matching buyers and sellers. Schibsted’s loan-lending comparison site, Lendo.se, is a moneymaker, one of the many services found around the real estate buying and selling experience. Other services parallel newspaper’s traditional roles in travel, food, and price/item comparisons overall.

Take a look at this list, and you can see how the buildout is moving along.

Schibsted Tillväxtmedier (Sweden) |

|

| Site | Category |

| TV.nu | TV guide |

| E24.se | business news |

| Prisjakt.se | price comparison |

| Lendo.se | personal finance, mortgage broker |

| Suredo.se | personal finance, insurance broker |

| Kundkraft.se | personal finance, group sourcing electricity |

| Letsdeal.se | coupons, daily deals |

| Resdagboken.se | travel community |

| Destination.se | travel search and booking |

| Webtraffic.se | ad network |

| Minimedia.se | ad production, inlets |

| Hardhatmedia.se | content production |

| Tasteline.se | food site |

| Hitta.se | directory |

| Jobb24.se | job classifieds |

| Servicefinder.se | marketplace for miscellaneous services |

Schibsted Vekst (Norway) |

|

| Site | Category |

| Letsdeal.no | coupons, daily deals |

| Duplo/Easy-ad | self-service display advertising |

| Mittanbut.no | marketplace for miscellaneous services |

The online-services business builds both on such legacy businesses as Yellow Pages (or Yellow Books, as they are called in much of Europe) and on such digital-age businesses as AngiesList. Most of the service sites were acquired by Schibsted, some after initial partial investment. Directory site hitta.se and three others were built from scratch.

One key to the online-services success, says Munck, is the “systematic building of traffic” to, again, claim a dominant position. While Schibsted uses its own media to promote them, Munck says, online services is “totally independent” and “respects the line [between editorial and marketing] in terms of promotion.”

Schibsted’s unique example draws heavily on a single idea: reduce dependence on traditional print ad and circulation revenue. To do that, the company has found market openings and exploited them with fierce determination.

The new businesses are all built to scale. The most mature is online classifieds. With singular technology costs, the rapidly spreading business becomes more and more profitable. Schibsted intends to do the same with 20 Minutes and with emerging online services businesses.

Tomorrow: Zeitung Online, a tiny news company with a “micronewspaper” model, just beginning to syndicate its platform and thinking. It serves as an experienced digital-first example for start-ups of all kinds and, especially for smaller, community newspapers, which often get short shrift in our digital transition thinking.