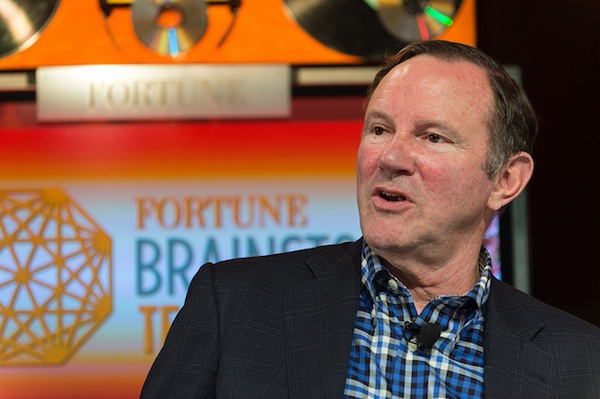

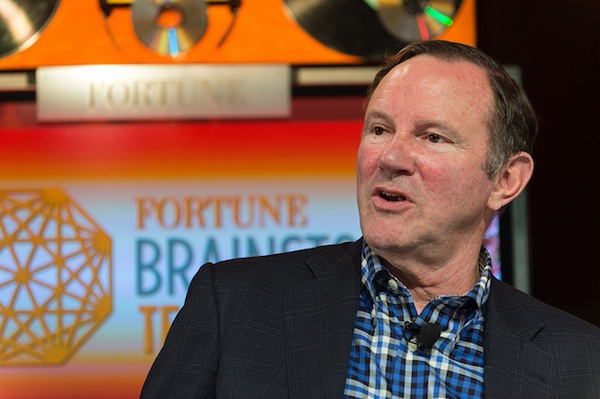

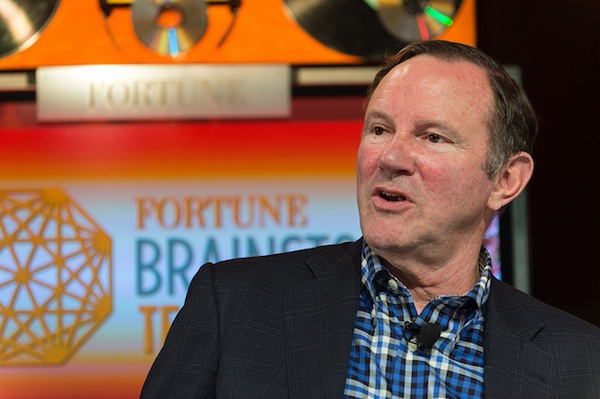

Washington Post Co. chairman and CEO Don Graham kept the decision to sell the heart of the family business exceptionally quiet for months, avoiding public drama and employee angst while he went white-knight shopping. He spent much of the first 24 hours after the stunning announcement that Amazon founder Jeff Bezos is buying the Washington Post making up for lost time in a series of interviews (among them separate sessions with the Post’s studio show The Fold, Ezra Klein for Wonkblog and Erik Wemple).

Washington Post Co. chairman and CEO Don Graham kept the decision to sell the heart of the family business exceptionally quiet for months, avoiding public drama and employee angst while he went white-knight shopping. He spent much of the first 24 hours after the stunning announcement that Amazon founder Jeff Bezos is buying the Washington Post making up for lost time in a series of interviews (among them separate sessions with the Post’s studio show The Fold, Ezra Klein for Wonkblog and Erik Wemple).

Graham and I spoke by phone shortly before he left to meet with employees at a printing plant included in the sale, a trip that reminded me of another Graham surprise — the 2008 appointment of his niece Katharine Weymouth as publisher of the Post. That day, Graham told me Weymouth’s job would be to manage the “transition from a world we know very well to a world that’s changing.” The real unknown, he said then, “what it’s a transition to.”

Now we know: it is a transition to a new owner. Graham and I talked about that decision, why Bezos has the seal of approval from Graham advisor and former board member Warren Buffett, and why innovation incubator WaPo Labs, Social Code, Slate, TheRoot and Foreign Policy are staying with the yet-to-be-renamed parent company.

Staci Kramer: Is there anything in the last 24 hours that’s given you a bout of seller’s remorse?

Donald Graham: No. Other way around really. I was somewhere between concerned and way too concerned about being able to tell the folks who work here about this without a leak. I wanted to tell my colleagues what we were doing and why and I’m glad we did. I’m glad we did. I would say many of them — not all — many of them expressed sympathy and understanding. Jeff’s personal letter to the employees, which he wrote, is so good that it helped a lot.

Kramer: You not only kept who it was sold to a secret, but you kept the fact that you were actively selling it a secret. Why go so far to be so quiet about it?

Graham: Because it spared people here the uncertainty of the period where you know the property you work for is up for sale and you’re not sure where the future is.

Kramer: Is that something you learned from the Newsweek sale?

Graham: No. The sale of Newsweek was also kept quite quiet until we announced it, but I’ve seen this over and over again through the years. Talk to the people today at the LA Times and Chicago Tribune. [Note: The Newsweek sale process was public.]

Kramer: What did you take from the Newsweek sale?

Graham: That’s a very good question. But I honestly don’t think anything that was relevant to this process.

Kramer: Anything about the kind of person you were selling to or the kind of structure you were trying to make sure was set up?

Graham: No. I wasn’t focused exclusively on buyers with a technology background. I wanted to look for someone who would bring something to the Post that we didn’t have and Jeff was a very, very good buyer on all accounts. Even better than I expected.

Kramer: Whose idea was Jeff?

Graham: It was a screamingly obvious idea both to me and to Katharine and to our investment bankers. I have to admit I did not think he would be interested because he’s famous for his single-minded focus on Amazon. But when it turned out he was, I was surprised. As I’ve said … Allen & Co talked to him on the phone a couple of times. He then stopped returning their calls and my assumption was ‘he’s not interested.’

Kramer: Screamingly obvious in a lot of respects but the two of you managed to stand next to each other at Sun Valley and be photographed and not set off any alarms.

Graham: We did. July 8, the Monday before Sun Valley, he emailed and said ‘let’s get together during the week’ and I said I’d love to.

Kramer: Were there any active negotiations going on with anyone else when you got that email?

Graham: We did — this I have said publicly — directly or through Allen & Co. I haven’t done an exact count but I think it would be right to say we reached out to fewer than a dozen potential buyers. One thing I’m not going to tell you is who we reached out to. It was not all technology people or technology companies. We reached out to people I thought could bring the Post something.

Kramer: Do you have any qualms about the Post no longer being owned by someone in DC?

Graham: No. Many newspapers, probably most newspapers are owned today by somebody who doesn’t live in the city of publication. I think it’s great when they are … Warren Buffett has bought newspapers this year; he bought the paper in Omaha, where he lives, but he bought the paper down the road in Richmond where he does not. I don’t think anybody’s insulted by having Warren Buffett as the owner.

Kramer: Although there’s a suggestion today that if the Washington Post was really a good business buy Warren Buffett would have bought it, not Jeff Bezos. My response to that was, ‘I don’t read minds but I would think Warren Buffett would suggest you sell to Jeff Bezos.’

Graham: Yeah. Warren’s quite a fan of Jeff’s. I didn’t really know that. I heard him in a large group in January saying he thought Jeff was the best CEO in the United States and I asked his permission to quote him when we went public. He’s a big fan of Jeff’s long-term focus , patience and not being distracted by Wall Street. He certainly won’t be distracted by Wall Street with this because it will be owned privately.

Kramer: How much does that matter in today’s world?

Graham: Even in running a public company, he is unusually long-term focused and unusually resistant to the idea that he should do things for short-term profitability. That’s why Warren says he likes him so much. But that’s also true of Warren himself. You can run a public company and be long-term minded but being a private company takes that out of the conversation altogether.

We have no complaints when it comes to our ability on the long-term. That has not been our problem. Our problem has been that we haven’t come up the right ideas.

Kramer: You’ve managed through five rounds of buyouts. Could you have continued to run the paper without going to layoffs?

Graham: I don’t know. One gigantic plus for the Washington Post — and it will be a plus for Jeff, too — among companies of our type, we’ve had a hugely over-funded pension plan and we have used some money from that pension plan from time to time over the years to fund buyouts and therefore to make it easy for people to step up and say ‘it’s time to go.’ I don’t know the answer to your question but, as I said yesterday, one reason we made this decision was this is our seventh straight year of declining revenue. I think we’re more innovative than most companies — I think you’ve written that. I’m very proud of the quality of innovation around here but it hasn’t reversed the trend for revenues. If in the next three years revenues were to decline, you’re going to wind up with more cost cuts however those cost cuts were achieved. After a few more years … we absolutely would have survived under family ownership and company ownership but our aspirations for the Post have always gone beyond survival.

Kramer: When did you personally realize you would be able to make the decision?

Graham: The very end of last year, the beginning of this year.

Kramer: Until the end of last year you never thought to yourself, ‘If I have to sell the Post I can do it?’

Graham: The very end of last year, the beginning of this year.

Kramer: People have said they’re surprised that you could sell. I was surprised by the timing and the person who bought it but not by the idea that you could sell it.

Graham: Katharine and I not only hadn’t wanted to do it; we literally hadn’t thought about it. Seven years of declining revenues will give you new ideas.

Kramer: Why are you keeping the digital assets and WaPo Labs? Were they for sale at all?

Graham: The Labs team is going to experiment in news products and it’s part of the contract is if it becomes profitable the Post will get a percentage of the profits. [The letter of agreement filed with the SEC gives WaPo Labs a five-year content license for the Labs’ social news aggregator; in exchange, the paper gets 10 percent of any profit.]

I hope we have a big success — and if we do, it definitely will be good for Slate and the other properties we own. What the Labs team needs to do now is put its head down and get out a great new product and make it a success. The Labs team at the moment is on the brink of what I think can be a very impressive new product. At the moment, we have no revenues so it’s not an attractive buy.

Kramer: What about Slate and the others? Was there any thought of selling them?

Graham: It’s a completely different business. I really enjoy Slate, The Root and Foreign Policy being part of us. It has nothing to do with the business of the Washington Post and our company’s proud to own them.

Staci D. Kramer, the former editor of paidContent, has been writing about and taking part in the intersection of technology with media, entertainment, and sports since the days before the web.

Image by Stuart Isett used under a Creative Commons license.

Washington Post Co. chairman and CEO Don Graham kept the decision to sell the heart of the family business exceptionally quiet for months, avoiding public drama and employee angst while he went white-knight shopping. He spent much of the first 24 hours after the stunning announcement that Amazon founder Jeff Bezos is buying the Washington Post making up for lost time in a series of interviews (among them separate sessions with the Post’s studio show The Fold, Ezra Klein for Wonkblog and Erik Wemple).

Washington Post Co. chairman and CEO Don Graham kept the decision to sell the heart of the family business exceptionally quiet for months, avoiding public drama and employee angst while he went white-knight shopping. He spent much of the first 24 hours after the stunning announcement that Amazon founder Jeff Bezos is buying the Washington Post making up for lost time in a series of interviews (among them separate sessions with the Post’s studio show The Fold, Ezra Klein for Wonkblog and Erik Wemple).