The morning’s RSS scan brings another couple of entrants in the ongoing conversation about paying for news on newspaper web sites:

OK, newspaper CEOs, let’s have a look at that urge to charge you’re roaring about every morning when you wake up. I ran some numbers derived from the NAA’s just-reported 2008 newspaper revenue recap. Here’s what the back of my envelope says:

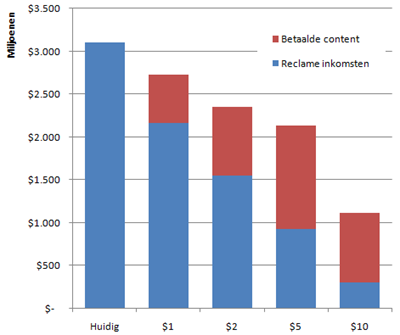

Total 2008 newspaper online revenue was $3.109 billion. Newspaper sites averaged 67.3 million monthly unique visitors in 2008, nearly all of them to free content. Now suppose a switch were turned, and each and every newspaper started imposing a monthly fee on all those visitors. Whether in the form of a monthly subscription or micropayments, clearly, the UV count would drop significantly.

I assumed that an industry-average $1-a-month fee would reduce traffic by 30 percent, $2 would knock off 50 percent, $5 would chop out 70 percent, $10 would say goodbye to 90 percent, and $25 would wipe out just about all of it. And further, I assumed that the 2008 ad revenue level of $3.109 billion would be reduced by the same percentage as the visitor reduction (which is probably a generous assumption).

So the question becomes: Will the new monthly fees offset the lost ad revenue? Here’s what happens:

Are these viewer retention assumptions valid? Granted, they come from the top of my head. If you disagree, make your own assumptions; the math is simple. We don’t have a lot of real-world before-and-after figures from news sites that have imposed fees. But we know, for example, that the New York Times’s 2005-2007 Times Select experiment drew 227,000 paying customers at an average of about $3.70 a month (based on reported revenue of $10 million a year), at a time when the Times’s free content was drawing 13 million unique visitors a month — a conversion rate of less than 2 percent. Or consider that the Wall Street Journal has about a million paying subscribers at $8.66 a month, versus 14 million monthly UVs at the free New York Times site. Print circulation for the two are roughly equivalent, but the Journal’s fee cuts its online audience to just 7 percent of the Times’s.

Based on this, retention rates as high as those I’ve modeled don’t look attainable, and retention high enough to increase net revenue is plainly not in the cards. (To get a net gain at a seemingly reasonable $5 a month rate, retention would have to be about 45 percent.)

A simple tollbooth approach at any price cuts out the vast majority of the audience, and would mean that newspapers were retrenching to print — saying in effect, “If you want our news online, it’s there, just pay the fee, but we’re no longer investing much energy in developing our sites, because there’s no money on that side of the fence.” A newspaper industry retrenchment to print would mean a withdrawal from competing online. The game would be to squeeze the remaining profits out of print while the clock runs out; while readers continue to migrate online, now to non-newspaper online-only sources; and advertisers follow the audience to the Web.

For newspaper firms to survive, they must become fully digital enterprises, engaging a broad audience online without barriers — although they may be able to charge for some very high-value content that goes beyond their core site offerings (see, for example, GlobalPost’s $199-a-year Passport service).

Daily print is not a long-term sustainable model, and forward-looking newspapers, rather than exploring an online paywall, should explore transitioning to a once- or twice-weekly frequency, focusing their print efforts on a weekend edition distributed Friday. (Explore my prior musings about this for more.)

UPDATE 4/05/08: Dutch blogger Marc Drees of Recruitment Matters has posted recap and commentary of this post, including a very nice graph summarizing my results:

(Red=paid content; Blue=advertising income; first column=present, 2008 baseline revenue per NAA)