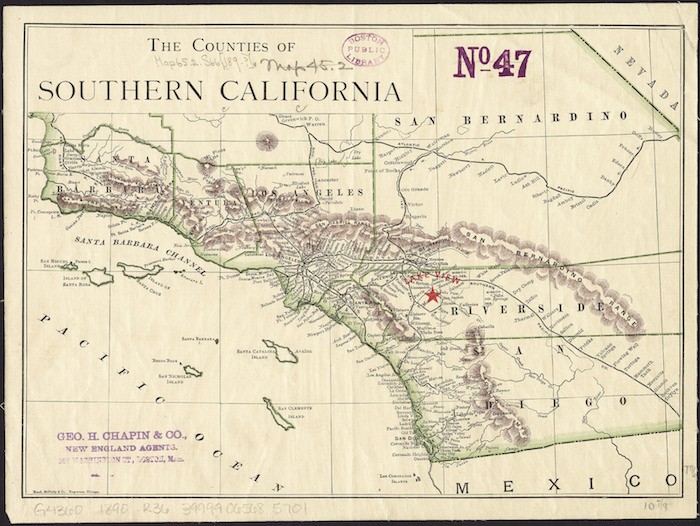

Southern California, poking northward into Santa Barbara and stretching southward to the Mexican border, will soon become Tribune Territory.

In a deal intended to be soon announced, Tribune Publishing will buy UT San Diego (the former San Diego Union Tribune) for about $80 million — and the assumption of growing pension obligations, recently upped to more than $100 million, I’ve learned through several confidential sources. Though, imminent, it is still possible that a final hiccup would delay a signed deal, as has previously happened in these negotiations.

Tribune Publishing refused comment on the transaction, saying only “it doesn’t comment on rumor or speculation.” Calls to the UT San Diego were not returned.

After closing, it is likely that the Los Angeles Times will operate the San Diego business, similar to what Tribune has done in Baltimore and Chicago. In those cities, the Sun and Tribune run the company’s local publishing acquisitions.

The sale – which I first outlined (“Tribune in final bidding for UT San Diego”) two months ago — will conclude an on-again, off-again auction. The sales process first started by developer and UT San Diego owner Doug Manchester last summer, has involved three sparring parties, the other two local.

The price compares to the $110 million that Manchester paid in 2011 to Platinum Equity — which had itself bought the company in a bottom-of-the-recession fire sale for about $35 million in 2009 from its longtime owner, the Copley family.

The buy would add the region’s No. 3 paper by print circulation to the Los Angeles Times, which despite many cutbacks over the years still dominates the print news scene in greater L.A. The Times can still claim a print circulation of 628,910 daily and 944,795 Sunday; U-T San Diego claims 268,038 on Sunday and 183,456 daily. (The Orange County Register counts itself barely ahead of U-T San Diego, at 302,802 Sunday and 192,567 daily. All counts are from the Alliance for Audited Media.) Of course, it’s the massive (but uneven) digital footprint of both the Times and the U-T that will matter most going forward.

And this big consolidation likely won’t be the last in the region. The Register, under new publisher Rich Mirman, still finds itself in the midst of financial triage, after the failed reign (“The newsonomics of The Orange County Register’s swerves all over the freeway”) of owner Aaron Kushner and executive Eric Spitz. As Mirman rationalizes both its ownership and operating plans, the Register is itself likely to be put up for sale, along with the Riverside Press-Enterprise that it bought only 18 months ago. Then there’s the hodgepodge of Los Angeles News Group (LANG) properties, about to be purchased by Apollo Global Management as it soon finalizes its acquisition of Digital First Media. I’ve long written about the inevitability of a Southern California rollup, as newspaper company woes deepen and cost-cutting through consolidation becomes a key weapon to hold on to any profitability in the transition from print to digital. The duo of Tribune Publishing CEO Jack Griffin and Austin Beutner, the outside-the-newspaper-box publisher he appointed (“The newsonomics of life after newspapers go solo — and new intrigue in L.A.”) only last August, believe in consolidation.Beutner believes that a consolidation of southern California newspaper properties is a financial necessity. Given the print ad downdraft — which is deepening, both at the Times specifically and generally elsewhere — every efficiency must be found. Though one can question how much efficiency remains to be squeezed through actual ownership consolidation — in recent years, many newspapers have found similar efficiencies through partnerships and contracting out — that’s Beutner’s belief. TPUB CEO Jack Griffin has already acted on that same principle, buying regional newspapers surrounding Tribune’s Baltimore Sun and Chicago Tribune in the first months of his leadership.

Make no mistake though: Southern California, with a population approaching 20 million, is Tribune Publishing’s big play. That’s a size that would rank it as the U.S.’s third-largest state, or about the same as greater New York City. Putting together the Times and the U-T — which only puts the further squeeze on the already pressed properties in Orange County and LANG — would give Tribune a kind of market power no single publisher can point to in New York.

That’s the simple proposition at work in this deal. The complexity behind it may be even more telling. Consider:

Further, San Diego’s civic community has never liked the shadow thrown on it by bigger Los Angeles. What will local mean as the Tribune/Times takes control of the property? We can expect that the U-T will maintain the brand – and that the Times will then consolidate all business and editorial efficiencies possible.

Tribune outlasted two San Diego-based would-be buyers. Radio exec and sometime Manchester associate John Lynch, whose duties were diminished more than a year ago, has worked since last summer to put together a deal. He told me his last period of negotiating “exclusivity” ended 10 days ago. Lynch had been working to cajole various monied partners to buy out Manchester for awhile.

Businessman and philanthropist Malin Burnham had worked tirelessly to put together a civic nonprofit. He aimed at running a daily operation deeply tied to community, but couldn’t raise sufficient money to convince Doug Manchester to keep the paper locally owned. Burnham’s group wanted a keep-it-in-San Diego discount; it made its final offer to Manchester on Monday morning.

Even with U-T San Diego’s profitability, investors are bound to look askance at a ninth metro newspaper asset. Griffin’s five-point turnaround plan, which he discussed on the first-quarter call (here via Seeking Alpha), makes good sense. The question for him, as for the heads of all publicly owned, market-sensitive newspaper companies, is: Will they be given enough time and money to make digital transformation strategies successful?

In short, Beutner, who comes from a private equity background rather than a publishing one, could be part of a new wave of modern media thinking much needed by regional press worldwide. The joker in the deck: How might this sale lead to a down-the-road Beutner-led private buyout of the Times/U-T business?

An annual PWC pension fund audit slowed the deal. Pension obligations swelled from about $50 million to about $111 million. While those obligations don’t represent money immediately owed, they present more of an issue for a public company’s books than for a private one. Why did the obligations grow? Two reasons: lackluster investment results and the faster-growing longevity of pensioners.

In its final offer, TPUB has been able to reduce its cash price, down about $10 million from its pre-audit March offer, in part because of the greater pension obligations.

In many newspaper sales, pension obligations contribute to the difficulty of valuation and sale — and then, of course, make operating budgets more challenging as print advertising continues its deep slide.

In the end, we come back to a truism about Doug Manchester’s three-and-a-half year ownership of the U-T. Ink doesn’t flow through Manchester’s veins; real estate does, and the Fairmont hotel he is building in Austin appears to trump the UT for his enthusiasm. After taking off much of six weeks to cruise around the Bahamas and other locales after his March deal was delayed, associates say Manchester returned newly prepared to make a sale.

Beutner’s L.A. Times, though, is proving itself out to be a liberal force in L.A., and he would presumably bring that perspective to San Diego. The days of by-the-old-book, down-the-middle objective journalism are clearly numbered overall, with Southern California now a prime case history in the reinvention of the local news business.