Inside the media universe, 2013 seemed to be a year of momentum. New money was being injected into the news business from all sides, from dot-com billionaires to baseball owners to venture capitalists making bets at the intersection of technology and content. At the same time, users were finding news and video through new platforms, whether through an explosion in social media or via the personal window of mobile.

In Pew Research Center’s latest State of the News Media report, just out, you get a glimpse of how the worlds of journalism and technology are continuing to merge and the impact that convergence has on the business and editorial prospects of media companies.

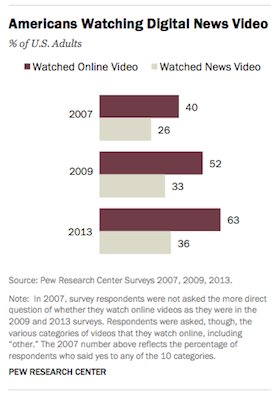

A majority of Americans now say they get news through a digital platform: 82 percent reported using a desktop or laptop, while 54 percent got news through mobile devices, according to Pew. Half of social media users share or repost news stories, while 46 percent discuss news on those sites. Audiences are also spending more time watching their screens: 63 percent of U.S. adults now watch online video, and of that, 36 percent watch news video.

At the same time, the companies that are helping to redefine digital news are expanding aggressively: Pew estimates that digital news operations, from the small hyperlocal shops up to the likes of ProPublica, The Huffington Post, and Vice have produced almost 5,000 full-time editorial jobs. Not enough to make up for a decade of losses in newspapers, but significant.

Traffic-wise, those companies are also challenging legacy media operations for audience. In April, May, and June of 2013, The Huffington Post averaged 45 million unique monthly visitors, which put it behind only Yahoo News as the top news site. BuzzFeed averaged 17 million monthly unique visitors, almost on par with The Washington Post’s 19 million monthly unique visitors.

“This year, what we saw was individuals tied to technology with a deep understanding of technology and digital content begin to tackle news reporting in a way we haven’t seen before,” said Amy Mitchell, director of journalism research for Pew.

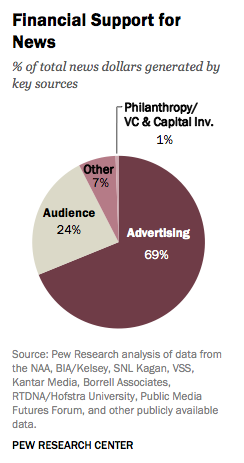

But the State of the News Media report also offers a dose of cold water to the digital media excitement: That new cash flowing in — whether through VCs, philanthropy, or personal investment — represents only 1 percent of the overall funding for journalism. Pew estimates that for-profit digital native news outlets pull in between $500–$700 million in advertising annually, which is just around 1 percent of all news-related advertising across sectors.

But the State of the News Media report also offers a dose of cold water to the digital media excitement: That new cash flowing in — whether through VCs, philanthropy, or personal investment — represents only 1 percent of the overall funding for journalism. Pew estimates that for-profit digital native news outlets pull in between $500–$700 million in advertising annually, which is just around 1 percent of all news-related advertising across sectors.

While the consumption of news on new platforms is rising, it still occupies a small space in the overall news industry, said Mitchell. “It’s all here, and real,” Mitchell said of the digital newcomers, “but also step back and look at the whole picture of news that consumers are receiving, and where does this fit in that? And it’s a small piece, at this point.”

On the business side, Pew found that audience-derived revenue — through paywalls, cable subscriber fees, and other sources — was growing both as a dollar figure and as a share of overall revenues. But it’s uncertain whether that increase is driven by a more paying readers or if news companies are just squeezing more money out of existing customers.

Mitchell said there’s still plenty of uncertainty in the business models for news. Nonprofit news outlets need to find sources outside of foundation funding; most news companies are still heavily dependent on advertising; and digital news sites are still developing new sources of revenue. “There is that big question mark next to the dollar sign that lets people think about what the future of sustainability is,” Mitchell said.

Circulation revenue at daily newspapers was up 5 percent for the year, driven largely by new paywall plans. But newsstand sales of magazines fell by 2 percent. While cable news audiences declined, local TV news saw modest increases in viewership, and evening network newscasts were up.

That’s all just the tip of the iceberg: As always, this is a huge report, with a wealth of information for media nerds. Pour a nice cup of tea, find a comfy chair, and set aside some time for reading. Here, in no particular order, are some of the more interesting takeouts from this year’s State of The Media report:

Pew estimates the U.S. news industry generates around $63–65 billion a year. But advertising remains the backbone of the business, making up two-thirds of revenue for news organizations. The area seeing the most growth is audience revenue, which includes subscriptions (digital or print), premium services (like Politico Pro), TV bills (cable and satellite), and the types of voluntary contributions that go to nonprofit news.

Daily newspaper subscriptions make up almost 70 percent of audience revenue, totaling $10.4 billion in 2013. But Pew’s research suggests that media companies aren’t pulling in new paying customers, but rather extracting more money from a shrinking pool. Giving to public radio stations was down by 3 percent in 2012, but the $400 million raised was still the second-highest dollar amount in 16 years. Similarly, Pew points out that newspaper and magazine circulation numbers are flat overall as subscription revenues are up.

According to data from eMarketer, digital advertising on the desktop web generates more than 3× the money of mobile. In 2013, desktop advertising brought in $33 billion, up a smidge from the previous year. Mobile jumped to $9.6 billion in 2013 from $4.4 million the previous year.

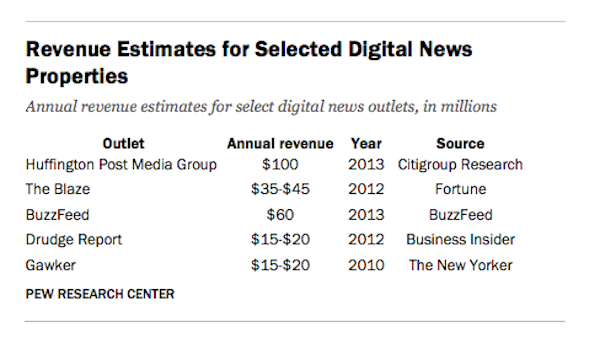

The report also included a good comparison graphic of revenues from digital-only outlets:

To get a better look at the emerging digital-only news environment, Pew surveyed 468 digital-only outlets, with 30 qualifying as “major” news organizations under Pew’s definitions. Combined, all these shops represent almost 5,000 full-time editorial jobs (though that figure also includes all of Vice’s 1,100 headcount, editorial or not). The 30 bigs, which include places like HuffPo, Gawker, BuzzFeed, Mashable, Business Insider, and ProPublica, accounted for about 3,000 of the new jobs created by digital-first news organizations. Of the other sites, 241 have three or fewer full-time staffers.

To get a better look at the emerging digital-only news environment, Pew surveyed 468 digital-only outlets, with 30 qualifying as “major” news organizations under Pew’s definitions. Combined, all these shops represent almost 5,000 full-time editorial jobs (though that figure also includes all of Vice’s 1,100 headcount, editorial or not). The 30 bigs, which include places like HuffPo, Gawker, BuzzFeed, Mashable, Business Insider, and ProPublica, accounted for about 3,000 of the new jobs created by digital-first news organizations. Of the other sites, 241 have three or fewer full-time staffers.

Pew found that many of the new newsrooms focused their reporting on topic areas left vacant by downsized print newsrooms. The digital outlets fell into three areas: local or hyperlocal news (think The New Haven Independent or West Seattle Blog), investigative reporting on the local, state or international level (ProPublica or the New England Center for Investigative Reporting), and international news. The focus on international news has expanded in recent years, with some, like GlobalPost, focusing solely on foreign reporting, but others like Vice, BuzzFeed, and Quartz expanding into overseas operations.

Who’s coming onboard? The hiring mix includes both legacy journalists and newcomers. At the investigative outlets, the balance is on people from traditional backgrounds. Kevin Davis of the Investigative News Network told Pew that 80 percent of 600 staffers at the 92 newsrooms in the INN come from legacy backgrounds. Business Insider CEO Henry Blodget estimates 10 to 15 precent of his staff came from legacy media companies. Josh Marshall of Talking Points Memo told Pew half his editorial staff have legacy backgrounds, but that he also tends to hire younger people. BuzzFeed editor-in-chief Ben Smith told Pew 20 to 30 percent of his editorial staff are on their first job.

Jobs report: For the time being, hiring seems to be disproportionately happening in the digital newsrooms. Using data from the American Society of Newspaper Editors’ annual newsroom census, the total number of full-time newsroom jobs in 2012 was 38,000. Between 2003 and 2012, 16,200 newsroom jobs were lost, according to ASNE. Similarly, Ad Age’s Data Bank reports that the number of magazine jobs has decreased by 26 percent in the past decade. (Pew also points out that job losses at Patch make the numbers for digital-only hiring less than rosy.)

One indication of how people watch online video: 88 percent of smartphone owners watch online video, and 53 percent watch news video. By comparison, only 35 percent of those who don’t have smartphones watch online video. Younger viewers are also more likely to watch online video. Nine in ten 18- to 19-year-olds watch online videos, and 48 percent reported watching news videos. That matches the viewership of the 30 to 49 demographic, and is much greater than the other age groups.

User-submitted video has become a part of most news operations, particularly for events like natural disasters, emergencies, and protests. But the number of people participating in creating those videos is relatively small: 36 percent of U.S. adults have reportedly shot video on their cellphone as of July 2013. Only 14 percent of social media users have posted photos of a news event to a social network and 12 percent have posted video. As for the audience submitting videos, photos, or writing to their favorite news outlet: Pew says 11 percent of “online news consumers” have provided a news outlet with content. That amounts to 7 percent of U.S. adults posting news video.

User-submitted video has become a part of most news operations, particularly for events like natural disasters, emergencies, and protests. But the number of people participating in creating those videos is relatively small: 36 percent of U.S. adults have reportedly shot video on their cellphone as of July 2013. Only 14 percent of social media users have posted photos of a news event to a social network and 12 percent have posted video. As for the audience submitting videos, photos, or writing to their favorite news outlet: Pew says 11 percent of “online news consumers” have provided a news outlet with content. That amounts to 7 percent of U.S. adults posting news video.

While digital video advertising is a small part of the overall digital ad pie — and even smaller still in the overall advertising picture — it’s growing. According to stats from eMarketer, video ads are growing 43.5 percent year over year. In 2013, digital video advertising revenue was estimated at $4.15 billion, up from $2.89 billion in 2012. However, according to the data, video advertising is only 10 percent of all digital ad revenue and 2 percent of all ad revenue.

Complicating things further is the fact that the online video advertising marketplace has quickly become crowded. Google, by way of YouTube, is the top online video property and the top destination for ads in the space, according to Pew. eMarketer projects that YouTube will pull in $850 million in video advertising in 2013, which would be about 20 percent of the overall video ad market. Fighting for the rest of that money are news organizations big and small, as well as places like Facebook. The slice of pie gets smaller when you factor in that news outlets share their revenue with ad networks.

On the local level: An audit of 32 local TV stations finds almost all (all but four) have video displayed on their homepages. The amounts vary among sites, and just half of the stations offer live-streaming video of their on-air programming. Interestingly, 24 of the stations have mobile apps that allow users to watch video. However, the type of video varied: More apps allowed users to watch clips, while fewer offered the option to watch live broadcasts. Pew found that many of the news sites host the videos on the sites themselves, rather than using YouTube or another service.In the local TV business, 2013 was dominated by business moves. In 2013, 290 stations were sold, up from only 95 the year before. The total value on those transactions in 2013 was $8.8 billion, according to data from BIA/Kelsey.

That’s changed the TV map around the country in a number of ways. According to Pew, a increasing number of stations in the same market are working through joint service agreements, meaning the stations are separately owned but operated together. Those agreements now exist in 94 markets, up from 55 in 2011, reaching almost half of the 210 local TV markets in the U.S.

The consolidation in local TV has also meant a shift in how news is produced by local stations. One in four stations do not produce the programs they air, according to data provided to Pew by the Radio Television Digital News Association. At the same time, content sharing is on the rise: More than three-quarters of local stations share stories with newspapers, radio stations, or other outlets in their community.

One interesting market: New Orleans. There, The Times-Picayune partners with WVUE, the Fox affiliate, where the station provides weather and video to the paper, and the paper’s reporters collaborate with TV reporters on projects and appear on air. Meanwhile, The New Orleans (née Baton Rouge) Advocate, which has risen as a competitor to The Times-Picayune, has a similar agreement with TV station WWL, recently sold by Belo to Gannett.

The hours of TV news being produced are still relatively high. The average hours of weekday news programming dropped by six minutes in 2012, but weekend newscasts increased by 11 percent on Saturday and 5 percent on Sunday in 2012. The biggest area of increase has been pre-dawn news, as the number of stations producing newscasts at 4:30 a.m. jumped to 634 in 2012, up from 245, according to Nielsen.

The distribution of news across social networks remains a mixed picture. As Pew reported last year, Facebook users are more likely to bump into news than seek it out. Facebook reaches far more adults in the U.S. than any other platform at 64 percent of the population. Still, only 30 percent of adults get news on Facebook. The numbers fall sharply from there. While 51 percent of adults use YouTube, only 10 percent get news there. As for Twitter, 16 percent of adults in the U.S. are sending and/or reading tweets, but only 8 percent are getting news there.

Facebook and search have become important to publishers as new pathways to stories. But Pew found that people who arrive on news stories through Facebook and search spend less time engaging with a site once they land there.

This may be a surprise to media watchers who clock endless hours on Twitter, but Pew found that sentiment on issues in the news on Twitter differs from those in the broader public. After the school shooting in Newtown, Conn., in 2012, Twitter conversation overwhelmingly supported stricter gun control, 64 percent to 21 percent. But a Pew Research Center survey during the same period found a close split in opinion, with 49 percent favoring more gun control and 42 percent saying they support protecting the rights of gun owners.

Full disclosure: Nieman Lab director Joshua Benton was a prerelease reviewer of parts of the report.