BuzzFeed, like many media companies, rode the tiger of Facebook growth, and has ended up in its belly. On Wednesday, the company laid out its plans to escape.

In a memo published this morning, BuzzFeed CEO Jonah Peretti laid bare some of the business challenges BuzzFeed and other media companies face, and he wasn’t shy about naming the source of the industry’s woes: Google and Facebook. These companies, he wrote, “are taking the vast majority of ad revenue, and paying content creators far too little for the value they deliver to users.” This power imbalance is at the heart of many of the issues the industry faces today, particularly the race-to-the-bottom dynamic that defines digital content, and the outsize role that filter bubbles have played in political discourse, Peretti argued.

Considering how important “distributed” media model is to BuzzFeed, this is the most critical I think I’ve seen Jonah be of Facebook and Google. https://t.co/DpoRCuGh7L pic.twitter.com/aMjLmSvUAN

— Jay Yarow (@jyarow) December 13, 2017

The sentiment is pretty stunning to hear coming from the CEO of a company that owes its much of its success to its ability to ride the algorithmic coat tails of the big platforms. But Peretti’s memo shows that the magnitude of the current duopoly problem has become large enough that it’s hurting even a company as large as BuzzFeed. Peretti’s memo comes a month afterThe Wall Street Journal reported that the company will miss its revenue targets by 15 to 20 percent this year. Meanwhile, Google and Facebook are expected to together control 63 percent of U.S. digital-ad spending in the U.S. this year, according to eMarketer.

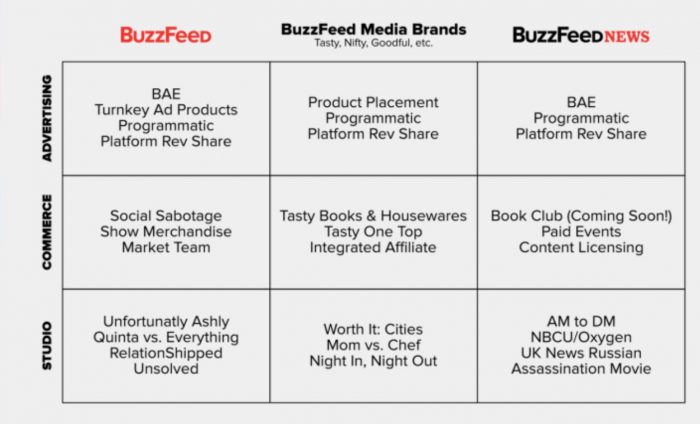

Peretti said that BuzzFeed plans to counter the dominance of Google and Facebook in two primary ways: One is by building a more diverse business model that’s focused less on direct-sold advertising and more on commerce, programmatic advertising, studio development, and revenue from platforms. He said that, by 2019, non-direct-sold revenue will account for over half of BuzzFeed’s overall revenue, up from 25 percent this year.

BuzzFeed Media Brands, which currently includes food site Tasty, health and wellness site Goodful, and home site Nifty, will also be core to the company’s future. For Peretti, the success of Tasty in particular shows that there’s a lot of opportunity in building non-politics, service-oriented lifestyle media brands that bring people together around a shared interest. (While Tasty got nine mentions in Peretti’s memo, “BuzzFeed News” appears just twice, though Peretti’s “nine boxes” diagram suggests that the news operation will continue to be a core part of the business going forward.) This lifestyle- and service-oriented strategy is similar to the one that has led The New York Times, for example, to acquire Wirecutter and launch verticals focused on meditation and running. The idea is catching on.Remember consumer loyalty to brands? Now brands need to be loyal to consumers. One of the big ideas in this memo. https://t.co/oxgfXVfKbT

— Jay Rosen (@jayrosen_nyu) December 13, 2017

The brand strategy, a new one for BuzzFeed, is something of an old one for legacy media companies like Meredith, Time Inc., Condé Nast, and Hearst, which are all built around a stable of established, meaningful news and lifestyle brands. Likewise, having more than one major source of income has always been a core part of healthy businesses in every industry.

Peretti’s conclusion is straightforward: “We’re growing up,” he wrote. The company’s new strategy is in large part a product of larger business realities out of its control, but:

We’ve outgrown the ability to build our business on essentially a single, very distinct revenue stream. We’ve matured into a portfolio of news and entertainment brands that attract very different audiences and can support diverse businesses. We all need to embrace this change, while fiercely protecting and strengthening the experimental, curious, fun and diverse culture that drives our success.