If you’ve been following our coverage of Journalism Online, the pay-for-news venture founded by Steve Brill, Gordon Crovitz, and Leo Hindery, you know how they plan to generate revenue for news sites. What hasn’t been clear is how the firm itself will make money.

But in a document submitted to the Newspaper Association of America, which was just made public, Journalism Online reveals its business model: They’re asking for a 20-percent cut of subscription revenue (after credit card fees).

I checked with Cindy Rosenthal, the firm’s spokeswoman, who confirmed the information and said they weren’t charging clients anything beyond the commission. Journalism Online says it has signed letters of intent with media companies representing 176 dailies but won’t disclose their names. Guardian News and Media and The Milwaukee Journal-Sentinel are the only known clients, and most major newspaper companies have said they aren’t on board.

[UPDATE: 10:36 a.m.: In a brief chat with Brill as I waited for the bus this morning, he said, “What we tell publishers is, we only do well if you do well.”]

Journalism Online had been the highest-profile of several firms known to be shopping paid-content solutions to news sites. But yesterday we revealed that Google is also making a play in that area, and much of the ensuing coverage suggested a new, if wildly imbalanced, rivalry between Google and Journalism Online. That will depend on how serious Google’s intentions are.

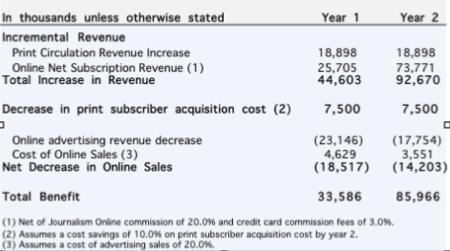

The basic pitch from Journalism Online involves news sites signing up 10 percent of their monthly visitors for some kind of subscription plan. (That figure has been floating between 5 and 15 percent.) But lots of content would remain free so news sites could continue to reap advertising revenue from non-paying visitors. Net profit, in Journalism Online’s models, emerges from subscription revenue, a slight increase in print circulation, and cost savings.

We’ve been through those models before, but the new document that Brill and his colleagues submitted to the NAA includes, for the first time, a model with all of their math in one place, including their commission and an abbreviated balance sheet. So for those following this really closely, here you go:

Below is an excerpt from the business models we have presented to five different-sized newspapers in five different markets based on assumption related to the options outlined above.

Print circulation of 1,000,000.

Total home delivery paper subscribers of 800,000.

Monthly online unique visitors of 20 million.

Annual online subscription price of $75.00 and month-to-month price of $7.50.

Micropayments per article of $0.25 with a total of 6 per subscriber per month.

Online advertising revenue of $175 million per year.

Print circulation revenue of $600 million per year.

Print subscriber retention and acquisition cost of $75 million per year.Bottom Line Benefit:

$33.6 million in Year One; $86.0 million in Year TwoAssumptions:

- Assumes a significant amount of continued free access, but with selected content offered to the most engaged online users on a paid basis. This approach optimizes advertising inventory alongside high-margin subscription revenues.

- 10% of monthly uniques subscribe within two years.

- Subscriber conversion breakdown assumes 47.5% annual, 47.5% month-to-month and 5.0% micro payment.

- Total online subscribers of 2.2 million subscribers in year 2, counting people who buy annual or monthly subscriptions or a single article through micropayment.

- Assumes a 90% subscription renewal rate.

- Overall page views decrease by 12% at the end of year 2.

- A 15% decrease in non-subscriber page views is offset by paying subscribers having 25% more page views per user than non-paying users.

- A 30% higher CPM for pages viewed by subscribers produces overall online advertising decline of 9%.

- Cost of sales for advertising is 20%.

- Journalism Online commission of 20% of subscription revenues net of credit card fees of 3%.

- Adding a paid strategy for selected online access, then bundling online and print subscriptions (offering a “discount” for those who buy both) yields a 3% increase over two years in print subscription circulation revenue.

You can download the 12-page document that Journalism Online submitted to the NAA or view it below (click in the top-right corner for full screen).