BI Intelligence, the company’s paid subscription research service, is aiming big as well. It has over 5,000 paying subscribers across its suite of offerings, it says, with around 30 dedicated staffers. It’s expanding its team, including hiring for a director of research to manage its portfolio for what it’s describing as an “international research company.” Intelligence’s staff and its number of corporate clients have each doubled in the last year, according to BI’s spokesperson. He declined to share more specific numbers but said the company’s research arm saw a 200 percent increase in revenue over the past year.

“I’m closing in on a year here, but even before I joined Henry [Blodget] and Julie [Hansen] sensed a real business opportunity with Business Insider Intelligence,” said Andrew Sollinger, executive vice president of subscriptions at Business Insider who runs BI Intelligence. “The concept is to supplement all the great work with a focused premium subscription, keyed in on various areas of digital disruption, and certainly how tech is slamming into every industry and turning them upside down.”

Sollinger joined Business Insider last year from Capital New York (pre-Politico rebrand), and is tasked also with implementing new paid content strategies at BI, which includes some form of a subscription component for the currently free site; Politico reports that’s coming sometime this year. The BI newsroom and the Intelligence arm are separate, and Intelligence revenue goes “back into the whole company.” “We’re like a little startup within a startup,” Sollinger said.

At the beginning of 2014, Henry Blodget, CEO and editor-in-chief of Business Insider, also told AdWeek that money made through BI Intelligence was not “propping up” the free Business Insider news site, and that it was simply a very good “second income stream.” BI Intelligence had just six employees then, and the division was hiring a reporting team to expand from research and reports to industry news coverage.

At the beginning of 2014, Henry Blodget, CEO and editor-in-chief of Business Insider, also told AdWeek that money made through BI Intelligence was not “propping up” the free Business Insider news site, and that it was simply a very good “second income stream.” BI Intelligence had just six employees then, and the division was hiring a reporting team to expand from research and reports to industry news coverage.

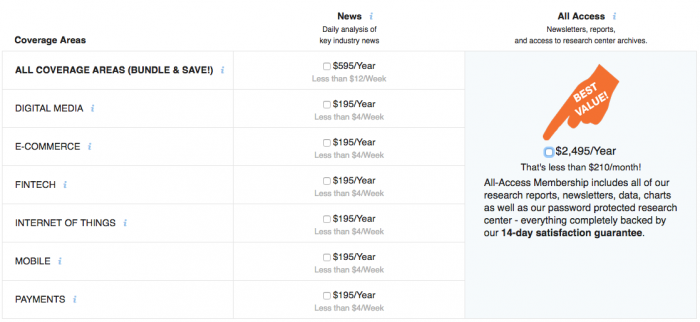

Intelligence now produces reports in six areas — mobile, digital media, payments, e-commerce, the Internet of Things, and most recently, fintech (financial technology; think Apple Pay, Venmo, Square) — along with daily Intelligence newsletter briefings, daily charts, and daily paid Insider newsletters tied to the news cycle. (Full disclosure: I’m set up to receive the daily Digital Media Insider newsletter, which includes links and analysis across the industry, for free. It’s listed at $295 a year, though you can sign up for $195 a year.)

Intelligence conducts its own primary research (this survey of millennials’ banking habits, for instance) and synthesizes data from other sources. Paying clients can submit questions and feedback (there was a free webinar with a BI Intelligence analyst to kick off the fintech vertical’s launch) though the team tries to keep the subscription services “as unbiased as possible so that one particular subscriber isn’t guiding the research.” Business Insider will often tease Intelligence reports on its news site, directing readers to subscribe.

Individual research reports are pricy — $395 or $495 per report — and an all-access subscription, which gets you Insider newsletters, access to reports, and more, costs $2,495 a year. (There other pricing options for groups: Harvard, where our little newsroom is situated, for instance, has licensed Intelligence for undergraduates, its business school, and faculty, a spokesperson told me.) Which, if you’re used to thinking in terms of newspaper subscriptions is way more than, say, a yearly Wall Street Journal subscription, but also way less than products from eMarketer or Forrester. (Gigaom’s then research service launched with a much lower price point. That didn’t quite work out.)

John Heggestuen, a managing analyst for BI Intelligence, is overseeing its newest fintech vertical from London. Heggestuen and his team in London are the company’s first international analysts.

“We have a different lens on this because we are looking at this from the U.K.,” Heggestuen said. (The U.K. has been pushing for a fintech friendly environment. Heggestuen also cited a PwC global survey in which 83 percent of respondents from the traditional financial industry feel they are at risk of losing some parts of their business to standalone fintech companies.) “That impacts how we interpret that research we do, but the fintech vertical is ultimately a global product.”

Heggestuen, who helped launch BI Intelligence’s payments vertical in 2013, said that Intelligence subscribers began requesting the team expand on the research they were doing in that arena: “It’s a natural extension of what we’ve done with payments, especially since our focus with BI Intelligence is how new technologies are disrupting these different industries.”

After the launch of Business Insider Germany, Julie Hansen, Business Insider’s COO and president, told me that the team frequently received requests for more research covering European and Asian data, and that the subscription research service could certainly expand abroad. Has Axel Springer’s acquisition of Business Insider changed at all the way the subscription research arm operates?

“Axel Springer is very keen on Intelligence. They’re letting us do our thing, the way they’ve been with editorial. We’re completely independent, other than them being completely encouraging of our work,” Sollinger said. “We’ve met with them and we’ve talked about how we can grow the research arm internationally — which is, interestingly, nearly half our audience. And I think that’s because folks operating in international markets are looking to the U.S., which is a digital leader, for trends they can take back to their own marketplaces.”