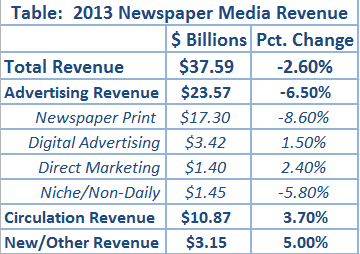

At Poynter, Rick Edmonds does us the favor of examining new numbers from the Newspaper Association of America on how newspapers performed financially in 2013. NAA’s totals suggest “the best performance since 2006” — which is still a revenue decline, of 2.6 percent year-over-year. The highlight is continued (relative) strength in circulation revenue, which was up 3.7 percent to $10.87 billion. (That total includes print subscriptions, single-copy sales, and digital paywalls.)

At Poynter, Rick Edmonds does us the favor of examining new numbers from the Newspaper Association of America on how newspapers performed financially in 2013. NAA’s totals suggest “the best performance since 2006” — which is still a revenue decline, of 2.6 percent year-over-year. The highlight is continued (relative) strength in circulation revenue, which was up 3.7 percent to $10.87 billion. (That total includes print subscriptions, single-copy sales, and digital paywalls.)

That’s the best spin. For the pessimist living in your cold, black heart:

— Print advertising revenue continues its massive slide, down another 8.6 percent in 2013 — another $1.6 billion gone missing. An annual decline in the high single digits has become the norm; you don’t hear people talking about getting back to par, as you did three or four years ago. NAA’s release notes that print advertising now “makes up less than half of total revenue,” which is true. But that’s not because of the strength of everything else; it’s because print advertising is in a state of collapse that isn’t going to stop anytime soon.

— Digital advertising — once touted as the savior of the business — was up a measly 1.5 percent. To put that in context, through Q3 2013, Nielsen estimated the online display ad market was up 32 percent. The broader online advertising world keeps growing; newspapers’ share of it keeps shrinking. (And much of that digital advertising number for newspaper still includes a lot of print advertising with a digital throw-in. Only 24 percent of what NAA counts as digital advertising is digital-only advertising.)

— Those two numbers combined mean that, in 2014, American newspapers still get 83 percent of their advertising revenue from print.

I feel confident in saying that newspaper print advertising will decline again in 2014, most likely in the high single digits again. Digital advertising will continue to muddle along with a slight increase. The key question for 2014 is whether circulation revenue gains can continue. It’s the only thing providing meaningful resistance to that ad decline.

Industry-wide, there’s probably some growth left, if only from more papers adding paywalls. Most American dailies still don’t have them (roughly 900 out of 1,400), despite the boom of the past two or three years. Many of those are small or weak enough that a paywall might be a hard sell, but there are still some candidates out there, and one could expect a boost in circ revenues just from them.

But for individual newspapers with existing paywalls, it’s a very real question. Are the John Patons right that digital subscription revenue is a one-time gain, destined to plateau or even fall off? If that’s true — and I think for many newspapers it is — you could easily see a bigger overall revenue decline in 2014 than in 2013.

(Just to get my predictions for these numbers next year on the record: print advertising down 9 percent; digital advertising up 1 percent; circulation revenue up 2 percent; new/other revenue up 6 percent; overall revenue down 3.5 percent.)

Leave a comment