The economic consequences of Covid-19 have not been distributed equally. It turns out this is true for news organizations, too. A new Pew Research Center report finds that the pandemic has hit some media sectors — namely, newspapers — much harder than others.

Comparing second-quarter reports between 2019 and 2020, researchers found advertising revenue at newspaper companies fell an average of 42%. Meanwhile, TV news — and one major network in particular — fared much better.

Total ad revenue across major cable news networks remained steady, but a closer look reveals the pandemic-related downturn has impacted each differently. The Pew Research Center found that though ad revenue for MSNBC and CNN declined by 27% and 14% (respectively), ad revenue at Fox News increased by 41%. It’s a reminder that the country’s most-watched channel — despite a series of sexual misconduct scandals, sharp criticism for downplaying the pandemic, and the high-profile desertion of advertisers from Tucker Carlson’s show — remains very, very profitable.

Among publicly traded local TV news companies, ad revenue dropped an average of 24%. Researchers found, however, that rising retransmission fees “more than made up for the losses.” Predictably, political ad revenue was up compared to 2019, though three of five local TV companies had seen higher political ad revenue for the same period in 2018.

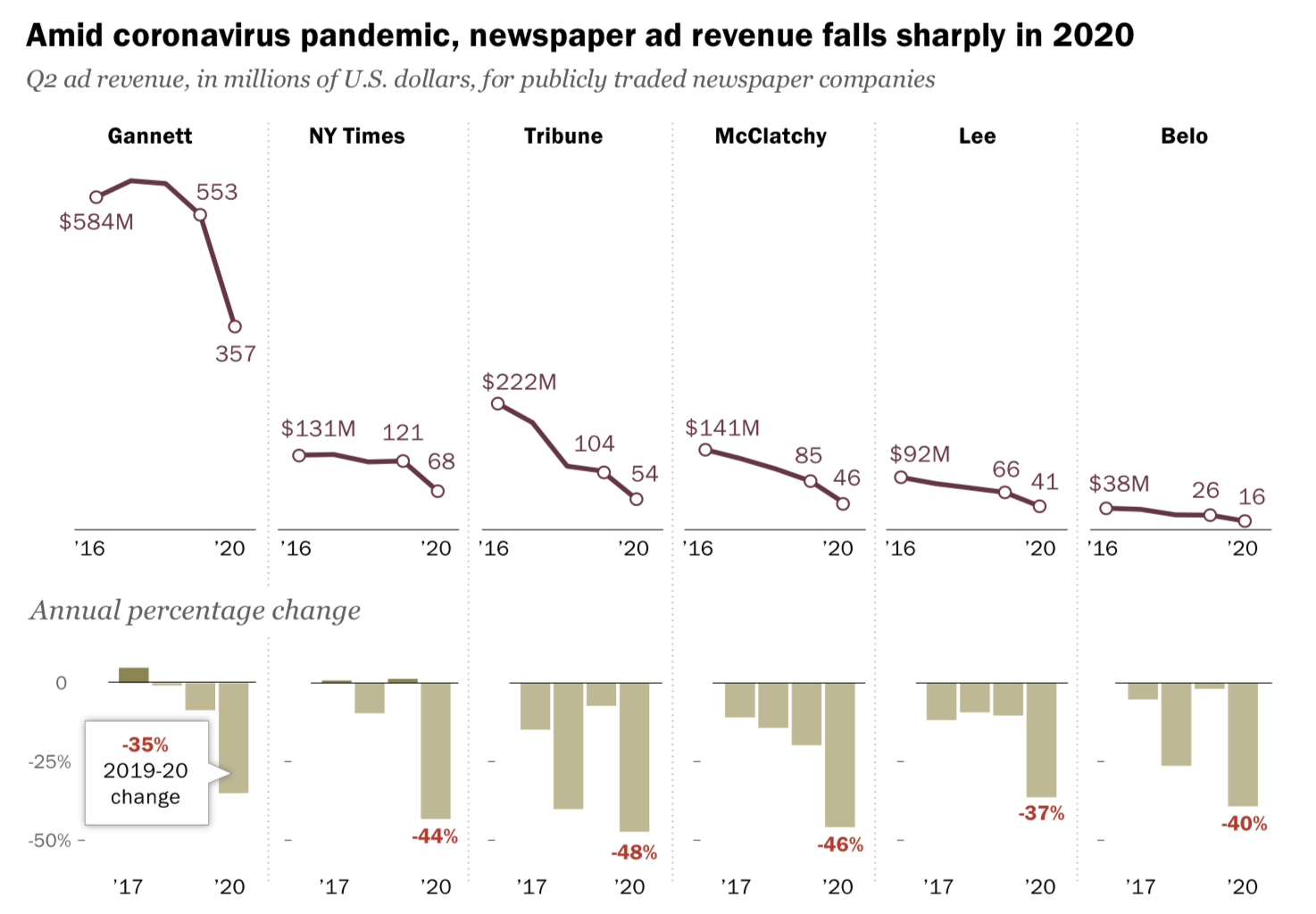

Looking at the advertising revenue losses at the six publicly traded newspaper companies collectively owning more than 300 newspapers reveals year-over-year losses that have only accelerated during the pandemic. Digital ad revenue — which dropped 32% between 2019 and 2020 — “offered little relief,” the report concluded.

Because newspaper circulation revenue declined less sharply — an average of 8% — three of these six companies now earn more revenue from subscribers than from ads. It would have been considered “an unthinkable state of affairs a decade ago,” the report notes, “when overall ad revenue was two-and-a-half times higher than overall circulation revenue.”

“This pattern was similar for all six newspaper companies analyzed here, with even the least-affected company, Gannett, showing a 35% decline in ad revenue year over year,” the authors added. (The six publicly traded newspaper companies studied were Gannett, The New York Times, Tribune, McClatchy, Lee, and Belo.)

Overall, these losses are steeper than those newspapers endured during the Great Recession, when second-quarter ad revenue declined, on average, 11% in 2008 and 30% in 2009.